Last updated: 13 June 2025

Sole Trader, Partnership, Trust or Pty Ltd Company. What’s the right business structure in Australia for you? This might be one of your most crucial business decisions – so getting it right is essential.

Whether you’re a first-time entrepreneur or a seasoned business owner, selecting the proper structure for your business can be challenging. There are multiple options, all with different pros and cons. Far too many business owners skip this critical decision altogether, effectively merging their personal and business interests and leaving themselves at risk. If you’re serious about going into business, then you need to get serious about properly structuring it.

TLDR: Quick Summary of this Legal Guide

- Choosing the proper business structure is an important business decision that too many business owners skip, effectively merging their personal and business interests and leaving themselves at risk if their business is sued.

- The 4 critical criteria to consider when choosing a business structure are: whether the structure protects you against personal liability exposure; whether you have (or plan to have) partners or investors in the business; the administrative costs of setting up and maintaining the structure; and, the tax effectiveness of the structure.

- There are 4 types of business structures in Australia: Sole Trader, Pty Ltd Company, Partnership and Trust.

- A Pty Ltd Company structure protects you from being personally liable as a company is viewed as a separate legal entity, allowing you to bring in investors and partners and structure your business earnings tax-effectively. However, these benefits come with formation and ongoing costs, as well as reporting, record-keeping and regulatory obligations.

When choosing the right structure for your business, here are the 4 most important criteria to consider:

- Your personal liability exposure from your business products or services

- Whether you have (or plan to have) partners or investors in the business

- The administrative costs of setting up and maintaining your business structure

- The tax effectiveness of the structure

Below you’ll find Legal123’s views of the pros and cons of different business structures – from a legal perspective. But before making a final decision, you should also check with your accountant – to understand each structure’s tax benefits.

Click on any headings below to jump to that section of this legal guide.

Legal issues covered in this guide

If you still have a question after reading this guide, get in touch as we’d love to keep adding your questions to this comprehensive guide.

4 Types of Business Structures in Australia?

In Australia, there are generally 4 options for structuring your business.

Sole Trader: Being a Sole Trader is the simplest and least expensive option. Designed for business owners who are the sole proprietors of their companies, this structure doesn’t give you much protection if things go wrong. Your personal assets are unprotected from any claims arising from your business.

Pty Ltd Company: Incorporation (i.e. forming a Proprietary Limited Company) effectively makes your business a separate legal entity from you. This structure involves quite a bit of paperwork and can be expensive to maintain. But it offers your personal assets protection from liability and only your company assets are at risk in the event of any legal actions and company debts.

Partnership: Creating a Partnership allows you to go into business with multiple people and share income. Partnerships are more manageable and less expensive than Companies to set up. However, all partners together are personally responsible for business debts and actions against the Partnership. And each partner is individually liable for debts incurred by the other partners. This means you have unlimited liability, unlike a Company structure.

Trust: A Trust isn’t an organisation but a legal structure to hold assets. For example, you might set up a Trust to hold your business assets and then appoint a Trustee to manage them. Commonly, the Trustee is a Company and the Trust provides asset protection and limits liability from operating the business. Trusts are very flexible for tax purposes. However, a Trust is a complex legal structure and establishing a Trust costs significantly more than a Sole Trader or Partnership.

That’s the summary. Now let’s look at each option in more detail.

Sole Trader Pros and Cons

As a Sole Trader, your personal assets (e.g. your house) are at risk.

A Sole Trader immediately comes to mind when most people think of a small business owner. The Sole Trader structure is for individuals doing business on their own. This structure preserves your right to make all decisions about your business but clouds any distinction between your personal and business assets.

The costs of becoming a Sole Trader are minimal and the application process is relatively simple compared to other business structures. Ongoing administration costs are also smaller. If all this sounds too good to be true, it might be.

Sole Traders are not wholly separate legal entities from their owners, which means that if your business is sued, you could end up paying the costs from your personal assets. You’ll also be stuck personally with your business debts, including any tax obligations incurred.

In addition, being a Sole Trader doesn’t offer you any real tax benefits (vs a Pty Ltd company). All-in-all, this business setup is less than ideal.

Can I change from Sole Trader to Pty Ltd or Partnership?

Yes, absolutely – you can change your business structure in Australia from a Sole Trader to a Pty Ltd company or Partnership. But don’t forget these steps:

- For Pty Ltd companies and Partnerships, you must register your new business structure with the Australian Government Business Registration Service.

- You may need to update your new business structure’s existing licenses or permits.

- You must inform your bank, insurance providers, etc. about your name change and business structure in Australia.

- Inform your clients and suppliers and update existing contracts, agreements, or business arrangements.

- Transfer assets, liabilities, and other relevant items from your Sole Trader business to the new entity. Be sure to consult your accountant about any tax implications.

- Once the transition is complete, deregister your Sole Trader business.

Does being a Sole Trader affect access to finance and investment?

Unfortunately, yes. Being a Sole Trader has advantages, such as more straightforward regulatory requirements, lower setup costs, and more direct control over the business. But access to finance and investment is limited because of the following factors:

- As a Sole Trader, the business is owned and operated by a single individual, which means there is no legal provision for issuing shares or equity to investors.

- Lenders perceive Sole Traders as higher-risk borrowers, making it more challenging to obtain loans or credit.

- Since a Sole Trader’s business and personal finances are not legally separate, the business owner’s credit history plays a significant role in obtaining financing.

- Lenders may require personal assets as collateral, which can increase the personal risk for the business owner.

Pty Ltd Company Pros and Cons

A Pty Ltd Company protects you from being personally liable.

If you’re serious about starting and growing a successful business in Australia, you should consider a Pty Ltd Company structure. This is a legal entity that is separate from you personally. If things do go wrong, your business mistakes are unlikely to destroy your personal financial assets. But for this to work successfully, you must keep your personal assets separate from your business assets – separate personal and business bank accounts, family home in your name, not the Company’s, etc.

If you incorporate as a Company, you’ll be a shareholder. You can be the sole shareholder or have multiple shareholders in your business. If you have multiple shareholders, they will usually have a vote on any significant decisions in your business. The voting rights and how your business is managed will be set out in your Company Constitution – a standard document in most cases – and your Shareholder Agreement. The Australian Corporations Act sets out the rules you must adhere to when managing your Company.

The primary drawback of using a Pty Ltd Company is that the formation and ongoing costs are relatively high.

An affordable option for incorporating your Pty Ltd Company (which you can do easily online) is $899 through Incorporator.com.au or $681 through Company123.com.au. This includes $576 of Government fees from ASIC. Bear in mind some accountants charge 2-3 times this amount.

Then you’ll need to file a company tax return with the ATO annually and update your ASIC registration details. The costs of an accountant to prepare and submit your personal and company tax returns can run between $1,000 and $2,500, depending on the complexity of the return and whether your accountant is located in a major Australian city or regional town. In addition, you’ll need to pay the annual ASIC Review Fee, which was $243 in 2015.

But a Company structure does give you some ability to structure your earnings from the business in the most tax-effective way.

What does Pty Ltd mean?

Pty Ltd stands for “Proprietary Limited”. In this context, “Proprietary” refers to the private ownership and control of the company, distinguishing it from a public company with shares traded on a public stock exchange. And “Limited” refers to the limited liability of the company’s shareholders. Limited liability means that the shareholders are not personally responsible for the company’s debts or legal obligations beyond the value of their shares in the company.

Pty Ltd vs Sole Trader?

Here is a summary of the Pty Ltd company structure vs Sole Trader:

- Legal entity: A Pty Ltd company is a separate legal entity from its owners, meaning the company has its own assets, liabilities, and obligations. A Sole Trader operates as an individual, and there is no legal distinction between the business owner and the business itself.

- Liability: Pty Ltd company shareholders have limited liability, which means their personal assets are generally protected if the company incurs debts or faces legal issues. The Sole Trader has unlimited liability for the business’s debts and legal obligations, meaning their personal assets are at risk if the business faces financial or legal issues.

- Ownership and control: A Pty Ltd company is owned by shareholders and managed by directors. Shareholders can be individuals or other entities, and the number of shareholders is limited. The Sole Trader business is owned and managed by a single individual, making decision-making quicker and more flexible.

- Taxation: The Pty Ltd company pays corporate tax on its profits, and shareholders may be taxed on dividends they receive. The Sole Trader’s business income is taxed at their personal income tax rates.

- Compliance requirements: A Pty Ltd company typically has more extensive reporting, record-keeping, and regulatory requirements than a Sole Trader.

Partnership Pros and Cons

With a Partnership, you are liable for all partners’ actions and debts.

If you have a business partner you trust and want to work with; a Partnership might seem like a good choice. For many Australian business owners, this approach works well. The costs of setting up a Partnership are relatively low and the annual administrative costs are less than a Pty Ltd Company. A Partnership also offers more financial reporting privacy compared to a (Pty Ltd or Public) Company.

Fun fact about Partnerships …

Generally speaking, a Partnership is limited to between 2 and 20 partners. However, there are exceptions laid out in the Australian Corporations Act. For example, a Partnership can consist of the following:

- 50 Actuaries, Medical Practitioners, Patent Attorneys or Stockbrokers

- 100 Architects, Pharmaceutical Chemists or Veterinary Surgeons

- 400 Legal Practitioners, and

- 1,000 Accountants!

A Partnership also allows you to pool your assets, making it easier to operate your business. For example, if you and your partner apply for a loan for office space, pooling your assets can make you (together) a more attractive loan candidate.

However, Partnerships offer little protection if things go wrong.

You’ll be personally liable for your business debts and lawsuits from poor business decisions. Worse still, in the same way, a Partnership allows you to merge your assets with your partner, you may also be liable for your partners’ debts. These risks can be mitigated with appropriate insurance coverage or by becoming a “limited” partner. For these reasons, we strongly advise anyone considering a Partnership to get professional advice and a very detailed understanding of your partners’ financial situation.

In addition, Partnerships do not offer any substantial tax benefits. Your Partnership doesn’t pay taxes directly. Instead, you and your partners must lodge annual tax returns and pay personal tax based on your share of the Partnership’s earnings.

Partnership vs Pty Ltd Company?

Here is a summary of the Partnership vs Pty Ltd company structures:

- Legal entity: A Partnership is an arrangement in which two or more individuals or entities jointly own and operate a business. The partners share profits and losses, and there is no legal distinction between the partners and the business itself. A Pty Ltd company is a separate legal entity from its owners, meaning it has its assets, liabilities, and obligations.

- Liability: In a General Partnership, all partners have unlimited liability for the business’s debts and legal obligations, meaning their personal assets are at risk if the business faces financial or legal issues. In a Limited Partnership, some partners may have limited liability. Pty Ltd company shareholders have limited liability, meaning their personal assets are generally protected if they incur debts or face legal issues.

- Ownership and control: Decision-making is typically shared among the partners according to their ownership stakes and partnership agreement. This can result in collaborative decision-making but may also lead to disagreements or slower decisions. A Pty Ltd company is owned by shareholders and managed by directors. Shareholders can be individuals or other entities, and the number of shareholders is limited.

- Taxation: The Partnership itself does not pay tax on its income. Instead, each partner reports their share of the partnership’s income and pays tax at their personal income tax rates. The Pty Ltd company pays corporate tax on its profits, and shareholders may be taxed on dividends they receive.

- Compliance requirements: Partnerships generally have fewer reporting, record-keeping, and regulatory requirements than Pty Ltd companies.

Trust Pros and Cons

Trusts do not have the tax advantages they used to.

Trusts are one of the oldest legal structures devised and have been used to handle everything from family inheritances to funding political activities. A Trust is simply an arrangement wherein an overseer, known as a Trustee, manages assets. If you entrust your business to a Trustee, it will act as a business manager, making decisions, disbursing funds and paying bills.

The Trust provides asset protection and limits liability from operating the business. Beneficiaries (owners) of a Trust are generally not liable for Trust debts, unlike Sole Traders and Partnerships. And the Trustee is typically incorporated as a Pty Ltd Company to give the Trustee some protection from liability too.

The main benefit of operating a Trust is that it gives you flexibility in how income from the Trust is distributed.

The Trust usually pays no tax but distributes its profits to the Beneficiaries yearly. This gives you some tax planning flexibility (taking advantage of the different tax-free thresholds and personal tax rates of each Beneficiary) that the other business structures aren’t able to. However, because Trusts have historically been widely used for tax avoidance, the ATO has been cracking down on Trusts.

The setting up and administration of a Trust is very complex and costly. You’ll have to draw up a Deed of Trust, which requires the assistance of a lawyer. And if you want to expand your business and retain profits to do so, you’ll be subject to penalty tax rates.

If you use the Trust option, you’ll probably ALSO use a Corporate structure for the Trustee and/or Beneficiaries, which involves additional costs.

Business Trust vs Sole Trader?

Here is a summary of the business Trust vs Sole Trader structures:

- Legal entity: A business Trust is a legal arrangement in which the Trust holds and manages the assets and operations of the business on behalf of the beneficiaries. The Trust is a separate legal entity from its trustees and beneficiaries. A Sole Trader operates as an individual, and there is no legal distinction between the business owner and the business itself.

- Liability: Trustees have limited liability for the debts and legal obligations of the Trust, depending on the specific trust structure and terms. Beneficiaries generally have limited liability, as their exposure is usually limited to their interest in the Trust. The Sole Trader has unlimited liability for the business’s debts and legal obligations, meaning their personal assets are at risk if the business faces financial or legal issues.

- Ownership and control: The Trust is managed by one or more trustees, who have a fiduciary duty to act in the best interests of the beneficiaries. Decision-making authority typically rests with the trustees. The Sole Trader business is owned and managed by a single individual, making decision-making quicker and more flexible.

- Taxation: The Trust itself is not taxed on its income, and instead, the beneficiaries are taxed on their share of the trust’s income when distributed. The Sole Trader’s business income is taxed at their personal income tax rates.

- Compliance requirements: A business Trust often has more complex reporting, record-keeping, and regulatory requirements than a Sole Trader. Establishing a Trust can also be more expensive and time-consuming.

Business Registration Requirements

Once you choose a structure, learn about trading names

Now, you need to Register your business.

Once you’ve decided on the best business structure in Australia for your business and chosen a business name, you need to Register your business and business name. And you need to do this with several different Australian regulators and organisations.

Fun fact about Registrations …

Irrespective of whether you’ve chosen to be a Sole Trader, Partnership, Trust or Pty Ltd Company, you will need the following:

- Registered business name

- ABN (Australian Business Number)

- TFN (Tax File Number)

and will probably need to register for GST too. So there are no differences between the various Australian business setup options here.

ASIC: First you need to sign up for an ASIC Connect account. You should have already searched the ASIC and IP Australia databases to make sure your business name has not previously been registered or trademarked. The ASIC registration fee is either $36 for one year or $84 for three years. You’ll be given an ACN (Australian Company Number) when your application is approved.

Australian Business Register: Next, you must take your ACN and apply for an ABN (Australian Business Number). An ABN has become a very important unique identifier of your business (necessary for opening bank accounts, filing tax returns, including on invoices, etc.) and every Australian business needs one. At the same time, you can register on this Australian Government website for your TFN (Tax File Number), PAYG (Pay As You Go) and GST. There are no registration fees for these registrations.

IP Australia: This step is often skipped by startup businesses but is vital for protecting your business, brand name and intellectual property. Although you have registered your business name with ASIC, this does not mean you have exclusive ownership. It can be used as a “trading as” name, “Pty Ltd” name or trademarked as a brand name. To prevent this, register your business name (and logo and tagline) with IP Australia. The costs of doing this vary depending on the number of “product categories” you want to cover but look to spend at least $500 to $700 for this extra protection.

Website Domain & Social Media: You also need to register your business online; nowadays, that doesn’t just mean a website address. It includes all the major social media platforms too! Register your “.com.au” and all derivative domains (e.g. .com, .org, .net, .mobi, .info, etc.) with a service like Webcentral (which used to be called Netregistry). And use NameChk to check if your business name is available on social media platforms like Facebook, Twitter, YouTube, etc. Registering on ALL these social media platforms isn’t absolutely necessary but at least have the majors covered.

Regulatory Licences & Permits: Whether this step is required depends on your specific type of business. The Australian Business Licence and Information Service are like a one-stop-shop for finding out what Australian licences, permits, approvals, registrations, etc. your business needs to meet its compliance obligations. Make sure you check it out!

For a step-by-step explanation of how to register your business, see our easy-to-understand infographic: How to Register an Online Business in Australia.

Summary of Business Structure Options

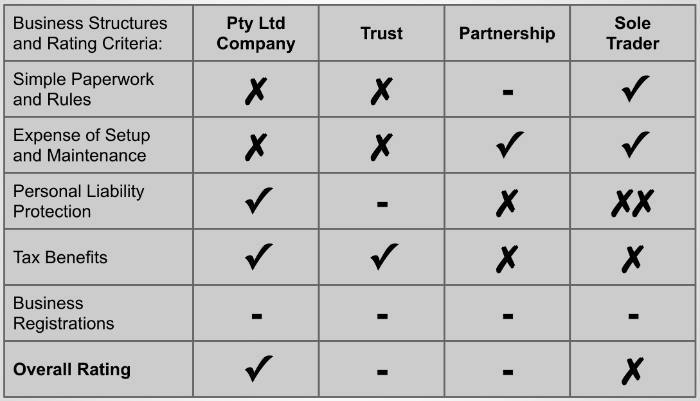

The table above summarises the pros and cons of the different Australian structures for your business. A tick is good, a cross is bad and a dash is neutral.

Overall we believe the Pty Ltd structure is best for most Australian businesses.

You’re not wedded to a single structure for the life of your business. But if you change your structure, it affects your taxes, liabilities, responsibilities, asset protection and ongoing costs. Similarly, you can change your business name, brand name, logo and business branding image anytime. However, the costs and risks of doing so are also not insignificant.

So spend the time during the startup phase of your business to get the structure, business name and branding right. It will save you a lot of time and money down the road.

If you need help choosing the right business structure in Australia and registering your Australian business, get in touch.

Book a 30-minute Call with Legal123

Need help with your business from an experienced legal professional? Then book a call with Vanessa Emilio, Practice Director of Legal123.

- Australian lawyer with 20+ years experience

- Ideal for entrepreneurs & business owners

- Advice tailored to your circumstances

- Quick answers to pressing legal questions

- Confidential discussion

- Easy online booking

- Rated

30-minute Call with Vanessa Emilio, Practice Director $99 +GST